1 min read

Research on Shelf Ready Display Packaging Trend Shows CPG Activity

Editors Note: This blog was originally published in February of 2018 but has been edited and republished with additional content around this topic.

5 min read

John Panaseny

:

Updated on July 30, 2020

John Panaseny

:

Updated on July 30, 2020

My colleagues and I normally use these articles to talk about technical packaging problems and business implications of different solutions. Our readers tell us it helps them solve problems.

Today I’m taking a different approach – to explore a problem without a clear solution but one with which I know nearly every CPG manufacturer is wrestling. The transition to shelf ready packaging has companies on edge – in a way I haven’t seen in 25 years in the packaging industry.

It’s fascinating and it’s worrying – and it’s also creating some interesting opportunities.

Here’s what I’m seeing at the intersection of my perspectives – mid size company CEO who sweats trends and strategy; US subsidiary of a German company familiar with long-term shelf ready packaging trends; and as a packaging machinery supplier to CPG companies.

We hear national security types talk periodically about “chatter.” They mean the volume (both number and volume) of background chatter among monitored channels. They sometimes interpret this as an important indicative signal.

At Interpack in May this year I detected a dramatic increase in “chatter” around shelf ready packaging. It struck me because of the sources – long-time friends and contacts from well established US CPG manufacturers. These were mostly corporate and plant engineers and maintenance folks who have years of experience riding the wave of packaging trends.

In fact, many of them over the years have told me specifically that SRP just doesn’t have the potential in the US for a number of reasons. And all our accumulated expertise in EU markets where it’s very widely (in some cases almost exclusively) used was interesting but not relevant.

And yet suddenly, one after another that I bumped into in the aisle or in our booth in Dusseldorf was saying the same thing. Shelf ready packaging was coming, and it was coming fast.

It’s easy for us to work on SRP projects. We’ve done hundreds of integrated installations in Europe – from pouching and bagging through palletizing. We’re familiar with the challenges of adapting existing equipment as well as the flexibility and process changes associated with redesigning lines.

But I sensed that we needed to do more than just respond with quotes – after all SRP is a widely cited but poorly defined concept. Simply assuming that our European configurations were applicable seemed risky. And it quickly became clear that the common standards which guided mature EU SRP were missing in the US in this early stage. Anecdotally we were learning of requirements to adapt….but most were really vague about the specifics of the adaptation. Why? How soon? What shelf & package sizes? There were far more unanswered questions than clear guidelines.

I sensed that we needed to dig deeper to understand the forces at play, and knew that if we could codify the circumstances and specifics into a set of guidelines, we’d have the opportunity to help CPG teams including marketing, sales, engineering, logistics and finance. One of the early, clear challenges was the unprecedented degree of interdepartmental and customer collaboration required for success.

So I gave my team the task of assembling some expert resources and developing a plan to create and share some resources. We’ve moved quickly and continue to do more. You’ll find a list of resources at the end of this article, and we’d welcome additional collaborations if you have ideas or recommendations.

We’re particularly enthusiastic about our collaboration with Chet Rutledge and Vanguard Packaging. Chet is the former Director of Private Brand Packaging at WalMart. He’s a guy who understands the how’s and why’s of SRP as well as anyone, and we’ve collaborated on a project planning guide and a webinar.

Among the important insights we’ve shared in this work are:

Among the important insights we’ve shared in this work are:

We went to PackExpo in Las Vegas with four months of intensive work in this space under our belts, complimenting years of experience in the EU.

And I was startled.

Conversations have progressed from “We’ve got to work on a plan” in May to “What can we do ASAP at minimal cost.” The pitch of conversation is approaching panic, and the timeline is often unrealistically short.

The good news is that often it’s possible to make some progress in a short window by changing die cuts and materials that run on existing equipment. But that raises two problems. First, absent the clear framework that’s been developed in Europe there’s a lot of confusion about sizes and standards in the US. In fact it seems that expectations vary widely by product category, department of store, and even the personal preferences of the category buyer.

Second, this approach may check the box, but it probably forfeits the other benefits of an integrated approach to SRP. Boxes may appear more “warehousy” than retail. Consumers may not find the shopping experience enhanced. Sell through may not get the boost it could to offset manufacturer investment. Manufacturers may not find the opportunity for standardization between retail customers. And the ancillary benefits (freight and warehouse cost, total material net, etc.) are likely missed – netting the manufacturer higher costs just as they assume and fear.

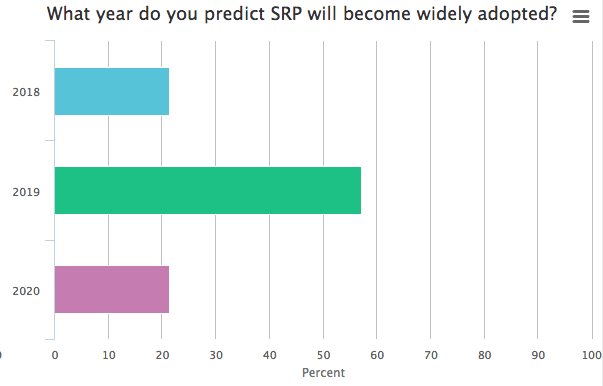

Based on these conversations I’m convinced that we’re going to see a two-phase implementation. There’s the reflexive, panicked, “get something done” phase that we’re in.

Later we’ll have a much more rigorous approach which incorporates perspectives from each department and discipline involved.

I’m also convinced that there’s a window of opportunity for agile manufacturers to implement complete solutions now which will give them a significant competitive edge in appearance, functionality and price which will help them to capture business for which they couldn’t successfully compete before.

I’m also sensing a growth in interest in an intermediate approach. Where a “100%” solution of full line reconfiguration is daunting, and a “10%” solution like changing materials/die cuts is a short-term fix, more companies are looking at how changing some secondary packaging machinery might net them a “60-70%” solution.

Many are looking for flexibility to meet uncertain requirements. Our EW-TI, for example, is a compact machine which can adapt to most existing line layouts and which runs in both wraparound mode for full traditional case, and is tray and lid ready for more sophisticated and attractive SRP configurations.

Another example is our side-load ELS machine which addresses one of the huge challenges of secondary packaging of standup pouches. This confounds many projects because the growing popularity of standup pouches in SRP systems challenges most case packaging which has traditionally been top load for pouches.

There are many chapters yet to be written in the story of shelf ready packaging adoption in the US grocery and retail sectors.

It’s clearly going to be an uneven process – with flurries or urgent activity and longer periods of retrenchment.

But it’s not going away, and while it won’t mirror the European model, our experience in that context provides us with an understanding of the engineering and packaging challenges which await companies making the switch.

Rovema North America will be a leader in this discussion and evolution. It’s one that I find personally challenging and rewarding, and it’s also one which we’re particularly well positioned to observe and support.

1 min read

Editors Note: This blog was originally published in February of 2018 but has been edited and republished with additional content around this topic.

On June 16 retail disruption was officially declared when Amazon announced its acquisition of Whole Foods. The full impact of this announcement has...

1 min read

It’s intriguing to read studies about food and supermarket psychology: how milk and eggs are located far from the entrance so shoppers get...