PackExpo ’17 – Retail Ready Packaging Collides with Business Realities

My colleagues and I normally use these articles to talk about technical packaging problems and business implications of different solutions. Our...

3 min read

John Panaseny

:

Updated on January 4, 2022

John Panaseny

:

Updated on January 4, 2022

Editors Note: This blog was originally published in February of 2018 but has been edited and republished with additional content around this topic.

Benefits for all stakeholders continue to spur the adoption of retail and shelf ready packaging. A report from Industry Research forecasts a 2.4 percent compound annual growth rate globally for the next six years. With this rate of expansion, the report, GLOBAL RETAIL READY PACKAGING MARKET SIZE, STATUS AND FORECAST 2022, predicts the value of the global retail ready packaging market will rise from $56.1 billion in 2020 to $68.4 billion in 2027.

Exclusive research by ROVEMA North America and Vanguard Packaging, an independent corrugated supplier based in Kansas City, MO, indicates this forecast could be understated due to dramatic growth in the adoption of shelf-ready packaging (SRP), a subset of retail-ready packaging.

Exclusive research by ROVEMA North America and Vanguard Packaging, an independent corrugated supplier based in Kansas City, MO, indicates this forecast could be understated due to dramatic growth in the adoption of shelf-ready packaging (SRP), a subset of retail-ready packaging.

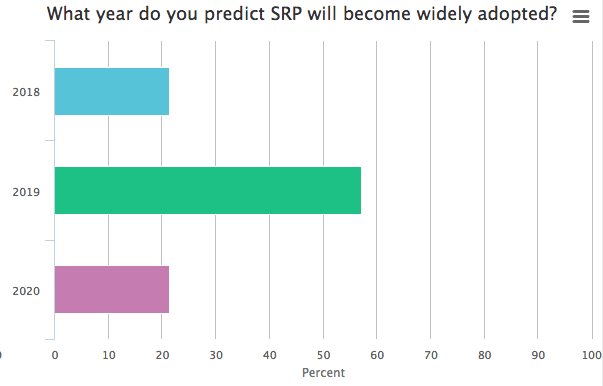

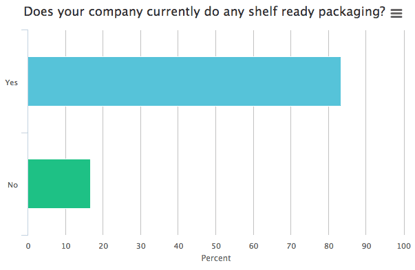

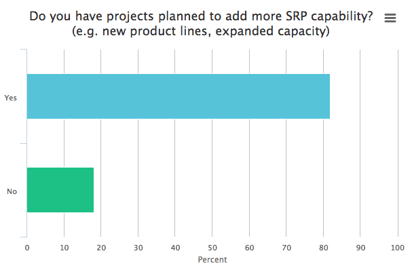

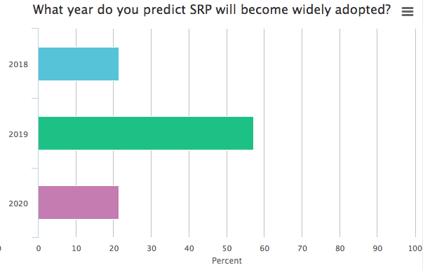

Research conducted by ROVEMA and Vanguard Packaging supports this prediction. Recent surveys of industry insiders showed clear progress and big plans. The results indicated that:

Retailers, led by Walmart, remain the driving force behind the adoption of SRP. Facing substantially higher labor costs, Walmart, looked for ways to reduce the labor needed for shelf-stocking time. “Reducing the labor cost of restocking shelves is the primary advantage of SRP,” according to Successfully Navigating Shelf Ready Packaging Disruption, Strategy Guide for CPG, a white paper co-authored with Chet Rutledge, vice president - Retail Ready Packaging at Vanguard Packaging and former director of Private Brand Packaging at Walmart. Less handling also means less damage and waste.

Other forces driving adoption of SRP include growing competition from deep discounters based in Europe such as Aldi and Lidl as well as the rising volume of e-commerce. SRP also provides product differentiation, sales lift due to better product availability (fewer stockouts) and sustainability benefits due to better space and cube utilization.

During their collaborative webinar around shelf ready packaging, Rutledge recalled one project where converting from lay-flat pouches to standup gusseted pouches in SRP provided space for 20 percent more product in a 20-foot segment. He noted, “This is valuable real estate for new products or expansion of existing products.”

The primary disadvantage of shelf ready packaging is the lack of common standards in the United States. Walmart, the company at the forefront of the transition to SRP, defines it as a system of “5 easies” – easy to identify, open, stock, shop and recycle. Other retailers follow similar guidelines.

Another frequently cited negative of SRP is increased material costs. However, these higher costs often are more than offset by better cube utilization, less damage, fewer stockouts and higher sales.

The last consideration of SRP is consumer perception. Like bag-in-box packaging, customers have the potential to see the added packaging material as wasteful or even as a device that has taken away jobs. As many business owners understand, finding employees has been difficult, so helping to make employee tasks more efficient only continues to be more imperative.

Despite the perceived disruptive nature of the shift to SRP, the transition can be smooth. With smaller store, shelf and kitchen footprints, SRP is well-established in Europe. As a result, ROVEMA’s world headquarters in Germany, has spearheaded many SRP projects. Their experience shows the most successful transitions to SRP involve a holistic, phased approach with intensive inter-departmental collaboration.

To begin, it’s imperative to work backward from the retail shelf. Considerations include position of the shelf (top, eye-level, bottom), product facings, case size, number of products per case, cases per pallet, pallets per truck and transit conditions. The transition to SRP also requires a careful, integrated review of the primary package style, the secondary package style and pallet load configuration, while considering material, appearance, functionality and handling from packaging line to consumer.

A phased approach consists of short-, intermediate- and long-term projects and design of graphics, packaging and process. Short-term, SRP can be designed to run on existing equipment, for example, switching from a standard regular slotted case to a five-panel case. In the intermediate-term (six to 12 months), there’s time to modify equipment or install a new machine for SRP. Long-term (one to three years) projects allow the time to work within routine capital equipment replacement cycles to design, build, install and inaugurate a flexible line that can produce today’s SRP design as well as tomorrow’s while improving throughput.

SRP benefits all stakeholders. Consumers enjoy a more favorable experience with the product, and retailers profit throughout their operations. For CPG manufacturers, SRP boosts sales due to increased shelf appeal and reduction of out-of-stocks and damaged product. In fact, a sales increase of 3-5 percent is not uncommon. Transition to SRP also offers the opportunity to optimize the supply chain by reducing SKU creep and improving cube.

However, as Rutledge explained to the webinar audience, “It takes time to do SRP right.” If 2019 is the target for a large-scale transition to SRP, work needs to start now to maximize the benefits to all stakeholders. If shelf ready packaging is something your organization is looking to implement, please contact us or connect with us in the help chat. 👉👉

My colleagues and I normally use these articles to talk about technical packaging problems and business implications of different solutions. Our...

1 min read

It’s intriguing to read studies about food and supermarket psychology: how milk and eggs are located far from the entrance so shoppers get...

It's no secret that one of the biggest trends in the packaging industry has been moving from rigid to flexible packaging. Walking through the...