Evaluating Existing VFFS Machines for Sustainable Films

Sustainable packaging materials are becoming increasingly popular, and many of today’s CPG brand teams and other stakeholders are evaluating ...

6 min read

John Panaseny

:

Updated on May 9, 2024

John Panaseny

:

Updated on May 9, 2024

Editors Note: This blog was originally published in April of 2020 but has been edited and republished with additional content around this topic.

Every company works hard to cultivate a great culture, build a great team and produce great products. In January 2020 those were key measures we used to compare vendors.

In March 2020 many realized belatedly that it’s not enough. In fact, if you can’t get key materials, components or services, your business stalls. All the most important factors become a mere footnote.

Important supply chain lessons are being learned - actually relearned - and new best practices will be written as disruptions move through stages.

Warren Buffett said that when the tide goes out you learn who’s swimming naked. Here’s how we believe things will unfold in the primary and secondary packaging machinery space, and how the naked swimmers will be revealed.

It has often been taken for granted that vertical bagging is primarily an engineering challenge, overshadowed by the complexities of running an entire business.

Prior to 2020, numerous machinery manufacturers competed for business, while OEMs and aftermarket specialists emerged opportunistically to provide parts. The greatest challenge for most companies had been retaining experienced operators, supervisors, and technicians who possess the expertise to keep production lines running smoothly.

But suddenly, everything changed.

International manufacturing shutdowns resulted in unfulfilled deliveries of consumables.

Just-in-time parts operations were exposed to the vulnerabilities of relying on material supply networks and machine shops facing closure, employee illness, and severe financial strain.

And the situation evolved further as more suppliers were forced to close due to government orders, illness, and disruptions in the supply chain.

Smart people running strong businesses will adapt. Consumables procurement will become more rigorous. Inventory levels will be adjusted. Details of component supply chains will be explicitly researched. Multiple vendors will likely be engaged - trading a bit of price efficiency for supply redundancy.

Those are the short-term, easy to anticipate (harder to execute) process changes. Costs will certainly rise. Vertically integrated, geographically convenient, quality manufacturers will understandably demand a premium.

Second-order challenges will lead to a larger mindset change.

Some capital equipment will become unsustainable as parts and technical support become unavailable.

Buying teams which already include engineering, maintenance, finance, operations, safety, controls and other functions, will consider more factors related to machine vendor resilience.

Changing a consumables supplier may take weeks or months of research and testing. Tearing out and replacing machines, which may not even be fully depreciated, will take months or years of disruption and enormous expense.

A long-standing packaging machinery industry tradition is the splintering of companies during good times. Common DNA in design is often apparent when engineers and technicians see an untapped opportunity in growing markets, grow frustrated with management that’s slow to respond, and hang out their own shingle.

Often they were right. There was an opportunity. Through hard work and ingenuity they grow a business. Sometimes it’s full machinery (e.g. VFFS.) Sometimes it’s an ancillary component (e.g. auger filler.) And sometimes it’s a parts business which they start because they’re troubled by what they see as excessive OEM replacement part costs.

And then the cycle turns. Business slows. Growth contracts. Orders decline.

And they’re swimming naked.

There’s a fundamental financial explanation.

But it’s one that’s forgotten over the decade long business cycle and it takes downturns to remind the market.

During good times it’s relatively easy for companies to get financing. If sales are growing, and they’re profitable, they can get the cash they need to grow more. Essentially they’re leveraging projections of linear growth to justify their plans to lenders. And the cash lets them buy more and hire more in a cycle of filling more orders.

Those orders come from customers who often feel personal loyalty and affinity to these corporate rebels, and who are intrigued by unique and different approaches to technical challenges. The resulting innovation moves the industry forward.

But the manufacturers and their customers are exposed as the cycle turns. Operations profitability, which is reflected in the P&L or Profit and Loss accounting statement, declines - or even turns negative - and things unwind quickly.

In challenging markets most equipment manufacturers lose money. In other words, profits are negative. (That’s the nature of boom/bust cycles of capital investment and part of the reason more manufacturers and customers are exploring recurring revenue / subscription models.)

When companies lose money, their resilience depends on how much they have in reserve to continue to serve customers, maintain inventory, retain experienced staff and continue operations at a loss. That’s reflected on the Balance Sheet which is the accounting statement of assets and liabilities - or how much the company has in “dry powder.”

The strength of the balance sheet doesn’t get much attention during strong markets. It’s the most important factor to understand in challenging markets. That will almost solely determine ongoing parts availability, continued R&D, the ability to retain the engineers and technicians who have years of accumulated science and black magic and the anecdotal familiarity with various circumstances, particular customers and unusual configurations.

Just as we now know some members of the population are particularly susceptible to the coronavirus, the financial model of some machine builders makes them potentially susceptible to negative market conditions.

Machinery down payments are used to finance operations.

That has two key implications.

First, as soon as new machine sales slow, operating cash starts to deplete. Tough decisions follow quickly. Should we use parts to finish pending orders? Or keep them for machines in the field? Can we afford to pay technicians who are desk bound? Can we continue to improve our HMI if cash is needed to support family lifestyles?

Second, just when companies most need outside cash, the cyclical nature of their business most jeopardizes their ability to obtain it.

Some machine builders are shown to be swimming naked even earlier than many other leveraged businesses.

Even though you might evaluate machines as an engineer, maintenance manager, operations leader or marketer (you want maximum package style flexibility, right!?) you should also keep financial considerations in mind. Your assumptions about a primary and secondary packaging machinery vendor’s ability to meet your needs will at some point rest fully on their financial strength.

Most primary and secondary packaging machinery manufacturers operate as privately-owned entities, which means they are not obligated to disclose their financial performance and strength to the public. This lack of transparency can pose challenges during the procurement process. So, how can a capital equipment buying team gather this crucial information? Asking the right questions is key.

Your team should build your own list of question. Here are some considerations based on your role. The willingness of potential vendors to provide answers can be just as informative as the responses themselves.

Potential vendors may refuse to answer. That’s their prerogative - and a factor for you to consider. Their comfort vs. your business resilience is a choice only you and they can make.

In general, though, a company’s experience managing through down markets is the best predictor you’ll have for how they will do so when it inevitably happens again.

So how does Rovema measure up?

Well, not only did we develop the first continuous motion VFFS bagger in the world, but in over 60 years we have endured 8 US recessions. And many of our employees have been with the company through many of them.

And while our balance sheet is strong and durable, it’s further backed by our owners, the Haniel Group. Founded in 1756 (264 years ago!) Haniel has survived and prospered through plagues, world wars, historical epochs and natural disasters.

The financial strength - the balance sheet based resilience - of Rovema, therefore, is immense.

While that might not have been a critical factor in many 2019 VFFS purchase decisions, we know that it will be going forward.

Our strength means that:

We anticipate that these and other questions will be important to you and your team as you evaluate vendors for upcoming machine projects.

And we’re committed to answering as fully as prudent business and mutual confidentiality agreements allow. John Panaseny, our CEO, and Suzanne Hanks, our CFO, are available to answer questions, provide reassurance and offer insight into our ongoing sustainability and resilience to support your procurement team.

We know that selecting a machine builder is an important choice. There are price and lead-time considerations today. Technical capabilities including speed, filling accuracy and package consistency are important. And long-term resilience is key.

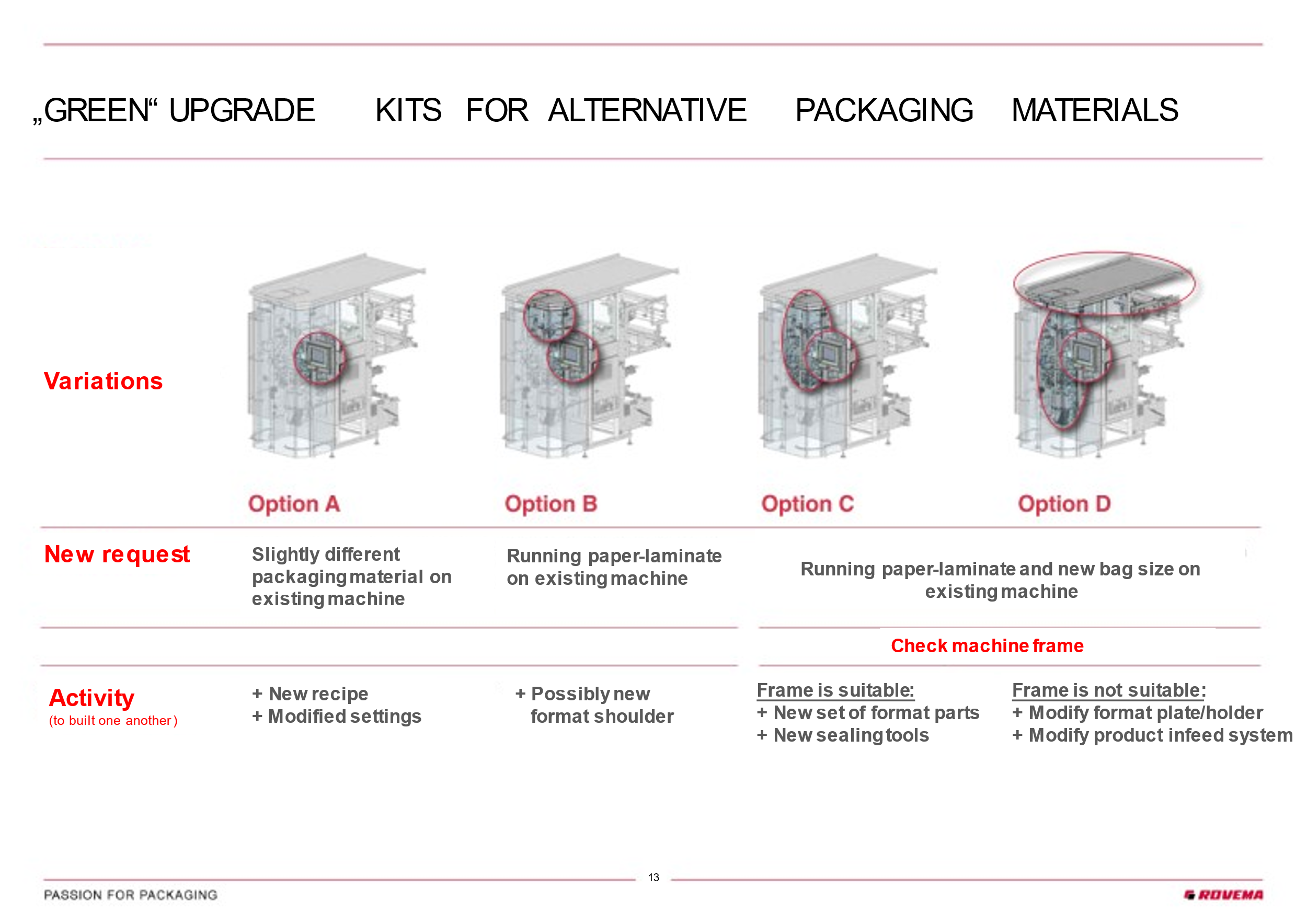

Sustainable packaging materials are becoming increasingly popular, and many of today’s CPG brand teams and other stakeholders are evaluating ...

Editors Note: This blog was originally published in March of 2021 but has been edited and republished with new data around this topic. Introducing:...

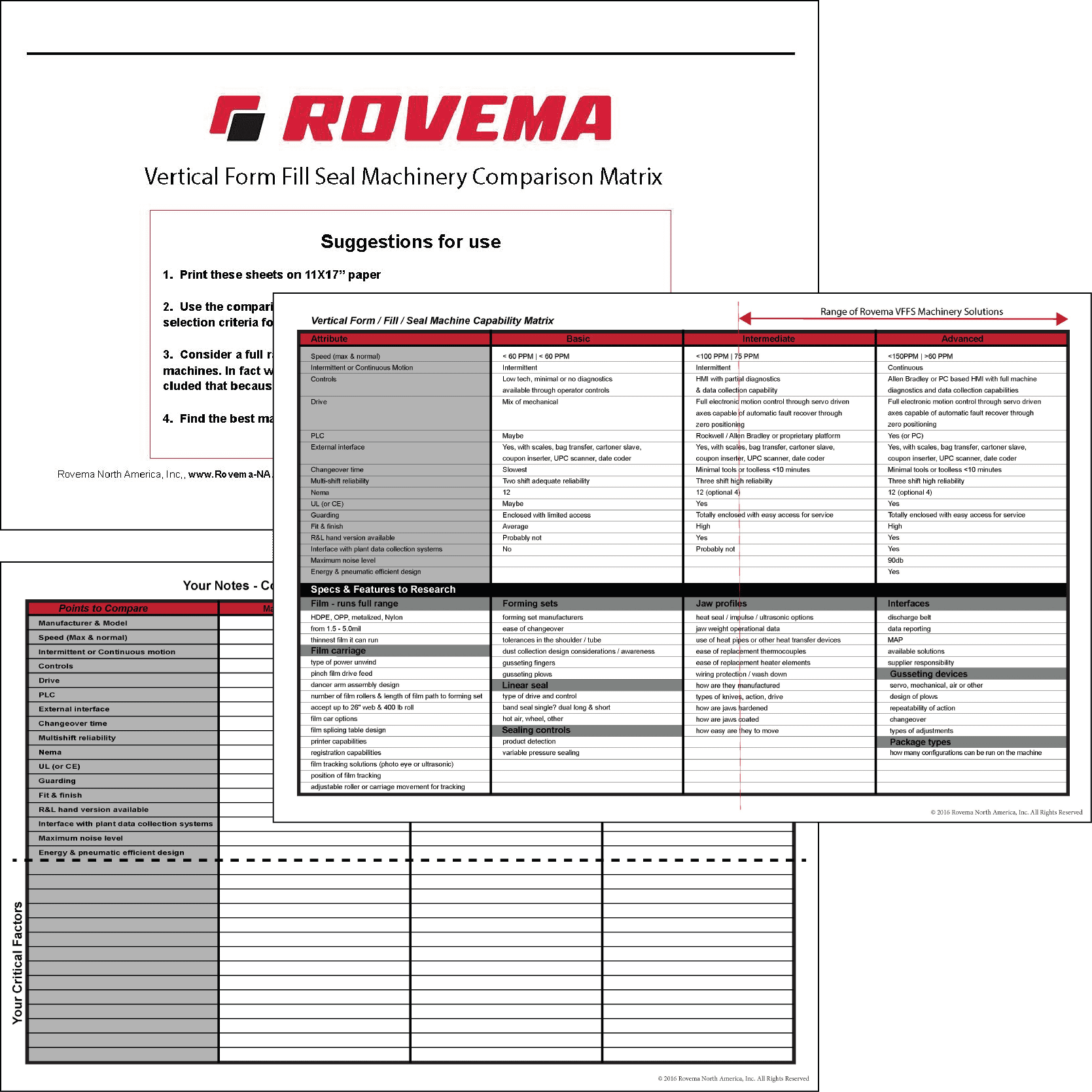

When you are considering upgrading, replacing, or adding a new vertical form fill seal machine to your operation, the options available on the market...