7 Things to Look for When Choosing a VFFS for Coffee Bean Packaging

There are numerous reasons why someone may consider a vertical packaging machine for their coffee packaging needs. Your business may be expanding and...

4 min read

Pan Demetrakakes : Updated on November 20, 2023

When it comes to coffee consumption, there are still a lot of pod people out there.

But unlike the plot of the sci-fi classic “Invasion of the Body Snatchers,” their growth is not inexorable.

K-cups, the latest version of the single-serve “coffee pods” that have been around for decades, swamped the U.S. coffee market since their advent in the early 2000's. Pods’ share of total U.S. coffee sales rose from practically nothing in 2000 to 34% in 2014, according to Euromonitor. Two precipitating events during that time were the recession, which led consumers to cut back on out-of-home coffee consumption, and the 2006 acquisition of Keurig, maker of the archetype K cup brewer, by Green Mountain Roasters. This created a marketing behemoth that propelled Green Mountain to the top ranks of specialty coffee roasters and helped establish K-cups as the No. 1 vehicle for single-serve coffee.

However, the K-cup is not quite as hot as it once was.

However, the K-cup is not quite as hot as it once was.

Sales of the Keurig machines, which had been growing steadily through 2013, started to decline in the last quarter of 2014 and have been falling since. Total sales of the pods are still rising, but the growth curve has flattened considerably: Euromonitor predicts that volume growth of K-cups will fall to 4% annually by 2019, compared with 82% in 2012.

Various reasons account for this loss of momentum:

Roasters who supply coffee in multi-serve packaging, especially flexible packaging, hope to make consumers aware of the relative advantages these alternatives have.

“There’s definitely still some environmental pushback on the [K cup] package itself. The recycling challenge associated with film and foil structures creates sustainability issues. There’s a lot of scrap generated by those cups,” says John Panaseny, CEO of Rovema North America. “The second thing is, typically people will say the quality of the coffee is not as good, because it’s not as fresh. The packaging doesn’t allow the sort of optimal solution for freshness. As people become a bit more sophisticated in their coffee drinking, they look for coffee that might be higher quality, and pouched coffee falls into that category.”

Freshness is one of the biggest advantages of pouched coffee—one that becomes especially important with premium product. Coffee loses freshness through exposure to oxygen after roasting. Such exposure is inevitable for K cups, but pouches have two ways to minimize it.

The first is by packaging coffee beans while they’re still hot out of the roaster. Otherwise, the roaster would have to let the beans sit and cool in the open, which would greatly increase oxygen exposure. The challenge is that hot beans emit carbon dioxide and other gases while they cool, at a rate that could cause sealed packages to swell or even burst. Pouches can accommodate this by incorporating a valve that allows internal gases to escape while keeping out oxygen.

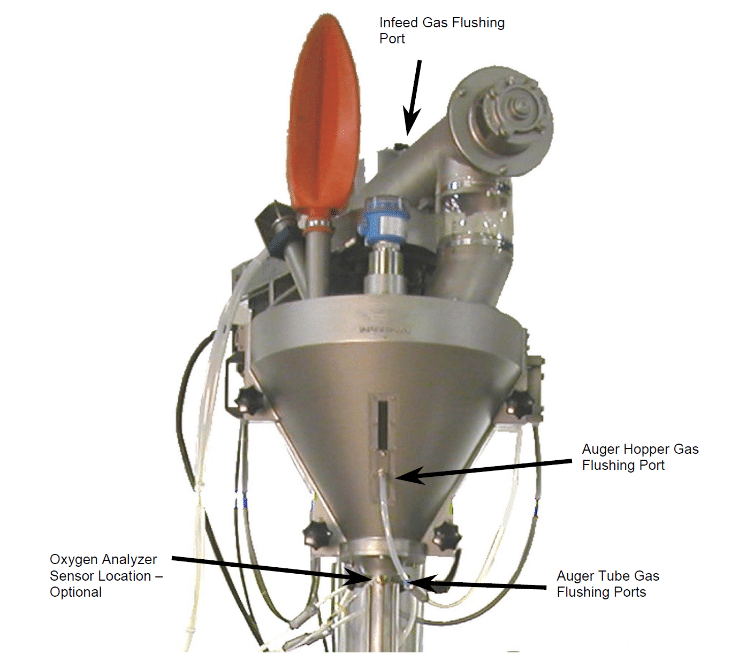

The second is through gas flushing. Pouch-packing machinery is available, through Rovema and other suppliers, that fill the pouch’s headspace with nitrogen at the point of packaging. The best such systems reduce the level of oxygen in the headspace to less than 2%. Oxygen analyzers often are used in conjunction with gas-flush fillers: either benchtop models that can be used to test random packages, or in-line ones that continuously monitor oxygen levels as part of the packaging system.

When it comes to the home coffee market, quality has the potential to be an even greater differentiator than price. Euromonitor notes that Nespresso, a coffee pod system that predates K cups (and is more popular than K cups in Europe), is enjoying rising sales in North America, mostly due to a favorable quality perception. “The issue is less that American and Canadian consumers are unwilling to pay for pods so much as that they do not feel that Keurig’s pods specifically are worth the mark-up,” a Euromonitor report states.

The office/institutional market is where K cups first took hold and where they continue to dominate, mostly because convenience counts more there: Office workers dislike getting stuck with cleaning up and making fresh coffee. But pouches have the potential for inroads there too, Panaseny says, with fractional packages, or “frac packs.” These hold just enough for a single pot of coffee, making them more convenient to use than larger packages.

“A big part of the K cup market was started through offices and institutional [uses],” he says. “That’s where we do a lot of business. What our customers are seeing is a much larger push to go back to the fractional packs as opposed to the individual K cups, again for coffee freshness and environmental issues. That’s what we’re seeing as drivers.”

Frac packs can offer the advantage of gas flushing for freshness. In addition, because they’re less expensive on a per-ounce basis than K cups, a company can offer its workers higher-quality coffee for the same price. Additionally film and valve suppliers are offering or developing solutions for the ability to allow the frac packs to de-gas with a valve or film for this package style. Panaseny predicts this will be a growing capability in the years ahead.

The path forward for coffee packaging

The bottom line is that coffee packaging is an industry in flux. Many competing priorities, considerations and preferences mean that it's impossible to predict exactly how the tensions will resolve themselves. So it's important for co-packers and coffee roasters to plan to incorporate as much flexibility into their lines as possible as they add production capacity.

Certain performance criteria (i.e. residual oxygen, fill level accuracy, reliability of outgassing valves, production speed, etc) should drive machine selection, and flexibility for various coffee packaging solutions in the future should also be heavily weighed as machines are spec'd and built.

To learn more check out our free on-demand webinar that discusses trends in coffee packaging.

There are numerous reasons why someone may consider a vertical packaging machine for their coffee packaging needs. Your business may be expanding and...

While oxygen is essential for our survival, it can be detrimental to the freshness and quality of coffee. Roasters worldwide face the challenge of...

You’ve heard the question, "If you were on an island and could only take three things, what would you bring?" It may take me a minute to come up with...