PackExpo ’17 – Retail Ready Packaging Collides with Business Realities

My colleagues and I normally use these articles to talk about technical packaging problems and business implications of different solutions. Our...

3 min read

John Panaseny

:

Updated on November 1, 2023

John Panaseny

:

Updated on November 1, 2023

The Amazon - Whole Foods deal has deservedly generated quite a bit of buzz. Especially considering the announcement caused stock in competing grocery chains and name-brand companies to immediately decrease. Most of the news is centered around the massive domino effect this takeover will cause while a few sources maintain that there is a lot of uproar with little actual ramifications of this event.

The Amazon - Whole Foods deal has deservedly generated quite a bit of buzz. Especially considering the announcement caused stock in competing grocery chains and name-brand companies to immediately decrease. Most of the news is centered around the massive domino effect this takeover will cause while a few sources maintain that there is a lot of uproar with little actual ramifications of this event.

The implications of this deal, whether real or imagined, go beyond the obvious transition of grocery shopping the way we know it. It raises questions of a future without cashiers and the loss of jobs in that segment. It raises questions of a transition with the traditional role of retail in general. And it raises questions of how this will affect CPG (Consumer Packaged Goods) manufacturers and the packaging machinery they will need.

Most people can agree that while a large amount of the discussion is around competing business models and distribution channels, for the foreseeable future groceries will be both delivered and selected off the shelf. Let’s analyze what this deal could mean and questions we might want to start to consider.

A product delivered to a home would have different packaging criteria from what is required in a grocery store. For example, the package delivered to your doorstep may not need to be as aesthetically appealing. The marketing appeal that differentiates itself from competitors while on the shelf or causes those impulse buys would not be as necessary for a product ordered online that can be delivered directly to your location.

Another point is that packaging needs would be different. One question to ask is will flexible pouches need to stand up any longer? The answer may indeed be yes, it is still vital, but it is a good question to ask. Why?

In stores, a stand up package offers that visual attraction and displays the product efficiently so a customer can easily see purchasing options. This is another attribute that purchasing online makes unnecessary.

As there is more of a cost to a stand up pouch, a pillow bag could be substituted. Pillow bags, like the stand-up pouch, also have the ability to be flexibly stored, can incorporate re-closeable features and save space. In addition, it has an added element of lowering material and manufacturing costs.

Something else to consider is that packaging that is left outside or used for drone transport would need to be weather resistant to prevent damage of the product. With the recent patent Amazon received geared toward packages being parachuted to your requested location, this opens up even more future questions.

Clearly, the packaging needs for a product presented in the grocery store or a product delivered to your doorstop will be different. But does this necessarily mean you would need multiple designs? This is an important issue that the Amazon-Whole Foods deal has made relevant.

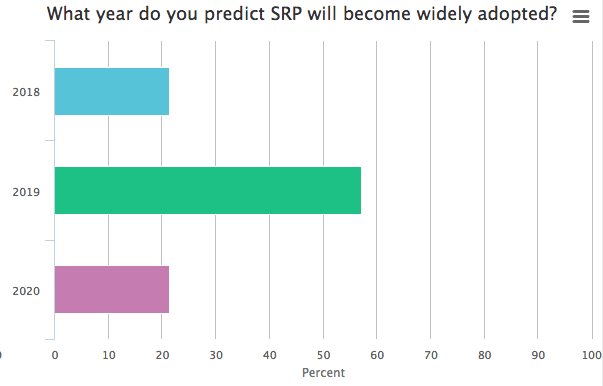

An important consideration for CPG manufacturers is that retailers are under cost and price pressure leading to trends like SRP (Shelf Ready Packaging) even without adding an online Amazon-Whole Foods deal to the mix. With competition from discount grocers such as Aldi and Lidl, SRP is smart way to reduce costs on labor and save space. Indeed, Walmart has been pushing its suppliers to transition to SRP.

On a side note, SRP is a subset of RRP (retail ready packaging) which is often used by wholesalers such as Costco.

The Amazon-Whole Foods deal may be a further impetus propelling SRP into a common feature of retail packaging. It could speed up the process and make it more relevant.

Another method for lowering prices is to focus on decreasing fuel costs by using flexible, lightweight packaging material that saves space and weight when compared to rigid containers. Film used with pillow bags or stand up pouches provide a lighter package that allows more space savings and lowers fuel costs.

Reevaluating secondary packaging is an opportunity for lowering prices for consumers and costs associated with packaging. Eliminating a secondary package such as demonstrated with a bag in box, decreases the environmental footprint, optimizes design and source sustainability and saves costs associated with the extra material.

Traditional packaging is fading. As companies are moving toward SRP packaging and lower costs through packaging material, why not also look at or think of other innovations or needs that are geared toward e-commerce capabilities.

Reinvention and decreased pricing are now even more vital for keeping up with competition and preventing grocery chains from going the way of Blockbuster.

We can’t claim that all of the actions mentioned will or should be taken. After all, this is new territory and grocery delivery still has a lot of kinks to work out. Rovema doesn’t profess to see 10 years in the future to know exactly how this will work. We do, however, spend time thinking of how to help companies automate product packaging in ways that are efficient. And we like to share what is happening now and the potential impact in the packaging world.

What are your thoughts or insights on how the Amazon-Whole Foods deal could affect shelf ready packaging? We'd love to hear what you have to say.

My colleagues and I normally use these articles to talk about technical packaging problems and business implications of different solutions. Our...

1 min read

Editors Note: This blog was originally published in February of 2018 but has been edited and republished with additional content around this topic.